Forced liquidation because of maliciious slippage

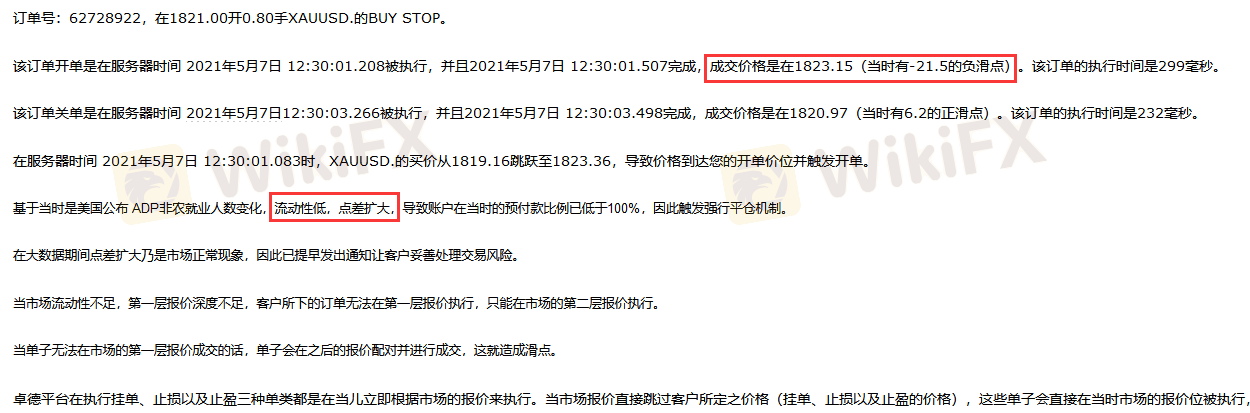

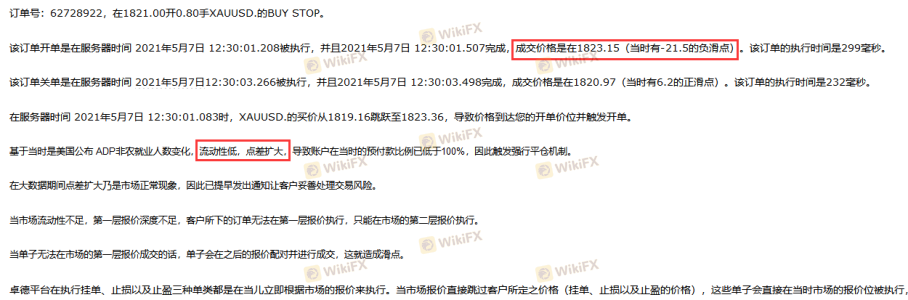

On the non-agricultural night of May 7, 2021, the pending order was 0.8 lot buystop, the pending order price was 1821, and the take profit price was 1826. As a result, the transaction price was 1823.15, and the account was liquidated when the price returned to 1820.97. If there is no slippage, the transaction at 1821 will not be liquidated at 1820.97, and the profit can be taken smoothly at 1826. The platform replied that it was caused by insufficient liquidity and no compensation would be given. If there is insufficient liquidity for even 0.8 lots of orders, what is the significance of such a platform? The reply from the platform can't satisfy me at all. This is a pending order, not a market transaction! ! ! If this is the case, what is the significance of the pending order? ? ?

The following is the original recommendation

恶意滑点导致爆仓

2021年5月7号非农夜,挂单0.8手buystop,挂单价格1821,止盈价格1826,结果成交价格为1823.15,并在价格回调至1820.97时账户爆仓。如果没有滑点,在1821成交,根本不可能会在1820.97时爆仓,并且可以在1826顺利止盈。平台回复说是流动性不足导致,不予赔偿。如果连0.8手的订单都能流动性不足的话,这样的平台还有什么存在意义? 平台的回复根本无法让我满意,这是挂单,不是市价成交!!!如果都这样的话,那挂单的意义何在???

Bangladesh

Bangladesh Vietnam

Vietnam