Be Cautious of Uptos – Avoid Signing Up With This Unlicensed FX Broker

Abstract:Investment markets always carry a risk of loss. However, it shouldn't be the result of your negligence, which refers to losing your hard-earned money to scam brokers that you can avoid with precautions.

Today, we discuss how shabby brokers like UPTOS defrauds investors and what you should do to prevent yourself from falling into their trap.

Uptos - A Quick Overview

Uptos (https://uptos.com/) is an offshore brokerage firm based in St. Vincent and Grenadines. The broker allows clients to access various tradable assets across multiple financial markets, including forex, stocks, indices, commodities, and digital currencies. The company claims to offer reliable trading conditions through its custom-built trading platform supported across all channels, including Web, Desktop, and Mobile. It also supports copy trading.

Is Uptos Regulated?

No, Uptos is not regulated anywhere in the world. Moreover, the company claims to be registered in St. Vincent and Grenadines. However, it doesn't appear in the search result on St. Vincent and the Grenadine Financial Services Authority (SVG FSA) website. What's more, the SVG FSA doesn't regulate or issue licenses to financial intermediaries dealing in forex and CFD trading. Therefore, Uptos is a scam.

Clientele Feedback

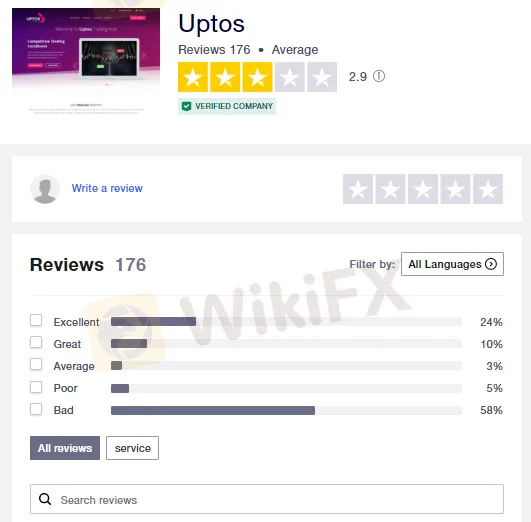

Clients seem to be highly disappointed with the broker. Almost 60% of investors have denounced the company for its poor code of conduct.

According to clients, the company stole their money through price manipulation. Traders have also accused the company of withdrawal issues, account closures, and poor customer support. Let us share some screenshots we captured from different reviewers' websites.

How does Uptos Defraud Traders?

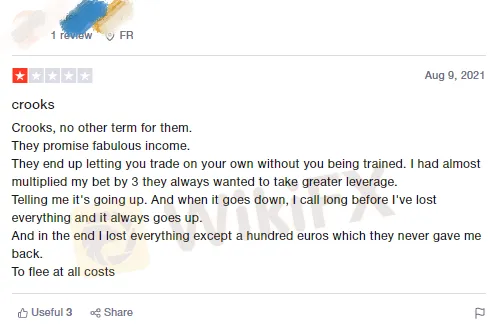

Uptos traps clients in an organized manner. When you visit a broker's website for the first time, you are unlikely to distinguish it from a legitimate platform. In addition to enticing them to use automated trading features for quick returns, brokers also come up with attractive trading strategies that attract investors.

From product listing and specifications to the publicity of advanced trading tools and features and claiming legal compliance, the company has every resource to make you believe it to be a trusted partner.

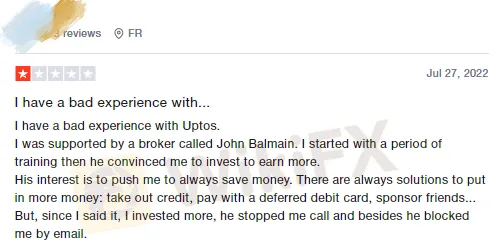

When you signup with the broker, its marketing team follow-up and urges you to make a deposit. Pretending to be your account manager, it assure you of a profitable trading endeavor.

After receiving funds from you, it either push you to make more deposits by luring you into special deals or persuade you to try its auto-trading feature.

According to clients, the auto trading robot brings you profitable trades initially. However, you start losing your positions after a while. Further, when you try to withdraw your leftover funds, the company drives you nuts and doesn't release your money.

Read more

FXCM UK Revenues Fall 12% Profits Will Drop By 95% In 2021

The revenue of FXCM UK for 2021 was $13.6 million, a 12% decrease from $15.4 million in 2020. The company's net profit for the year decreased from $4.9 million in 2020 to only $227,982 in 2021, just over breakeven.

Rakuten Completes Securities Business Reorganization

According to Rakuten Group, the establishment of Rakuten Securities Holdings, Inc. and the reorganization of the securities firm were completed as planned.

Scam Alert: DtpFx Ltd's Costumer Services Ignores Inquiry about its Regulation

DtpFx Ltd is a forex scam warned by FCA recently. However, it hasn't stopped its steps to scamming after being warned.

Scam Alert: Avoid Trading With Cryptocurrency Scam CryptoAllDay

Although digital currencies have been around for over a decade, the concept is still foreign to many.

WikiFX Broker

Latest News

OvalX (formerly ETX Capital) Loses Money in 2021, Client Count Increases

Beware This Unregaluated Broker CryptoAllDay - Scam Alert!

Analysis-Under water: how the Bank of England threw markets a lifeline

PU Prime’s Mohanad Yakout Joins OnePro as Global Head of Market Research

Bank of England’s FX Dealer Chris Mills Departs after 18 Years

OvalX (Previously ETX Capital) Turns Loss in 2021, Client Count Jumps

Over trading a sure way to blow your account

Pound jumps on UK tax cut reversal, oil swings higher

Instant View: British pound up as govt makes U-turn on tax cut plan

FXCM UK Revenues Fall 12% Profits Will Drop By 95% In 2021

Rate Calc