Why FX Brokers Need to be Regulated?

Abstract:The rules and laws forex firms must follow are referred to as forex market regulations. The goal of regulation is to keep you safe from hidden financial risks, abusive practices such as price and order manipulation, and fraud.

Getting a regulated status is crucial for a forex broker, especially one serious about conducting legitimate business operations. However, many self-operated brokerage firms choose not to apply for such regulation from external institutions.

Any platform under an authority‘s supervision will be operating its business ethically and meticulously. A regulated broker ought to put the interests of their trading clients before their own. Although an authority body does not interfere or participate in a broker’s day-to-day business operations and internal management matters, the severe penalties are enough to keep them operating in an ethical manner. Should a regulated forex broker start operating recklessly or become part of any illegal activities, the regulatory body would implement punitive actions, such as a monetary fine, temporary license revocation, or a permanent ban from any forex-related businesses.

Being regulated requires the broker to be under a certain level of governance, including financial status, business structure, the trading platform provided, and other relevant aspects. Its operation will also be more standardized as they often have to undergo a series of periodic reviews, audits, evaluations and checks on a monthly/quarterly/annual basis. From customers point of view, they have gotten enough protection and a sense of security. In turn, they can also be loyal customers contributing to the firm's profits. This is a win-win situation for both parties.

Download the free WikiFX mobile app from both Google Play and App Store.

Look for your brokers profile in our database.

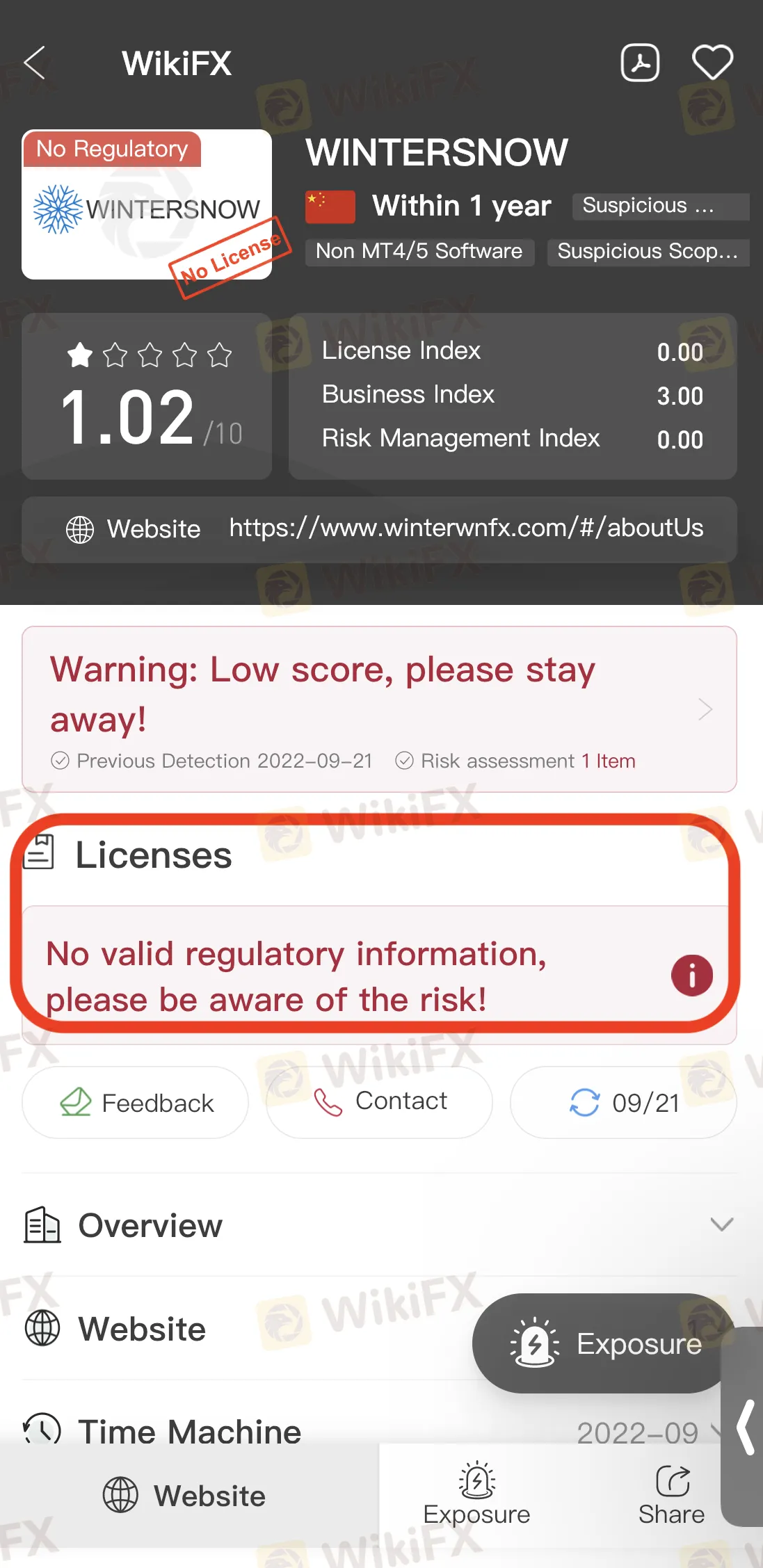

WikiFX makes things easier by clearly stating the regulatory status of a forex broker. Say no more to getting involved with unregulated brokers from now!

WikiFX Broker

Latest News

OvalX (formerly ETX Capital) Loses Money in 2021, Client Count Increases

Beware This Unregaluated Broker CryptoAllDay - Scam Alert!

Analysis-Under water: how the Bank of England threw markets a lifeline

PU Prime’s Mohanad Yakout Joins OnePro as Global Head of Market Research

Bank of England’s FX Dealer Chris Mills Departs after 18 Years

OvalX (Previously ETX Capital) Turns Loss in 2021, Client Count Jumps

Over trading a sure way to blow your account

Pound jumps on UK tax cut reversal, oil swings higher

Instant View: British pound up as govt makes U-turn on tax cut plan

FXCM UK Revenues Fall 12% Profits Will Drop By 95% In 2021

Rate Calc