Related product: Forex

Market analysis: XLM Price Prediction: Stellar could rally 10% if it can breach this critical level

XLM price performance shows a lack of buyers, which has kept it from reclaiming its range low at $0.274.

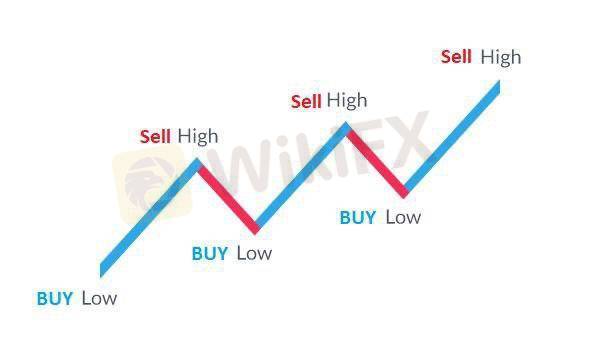

A decisive 4-hour candlestick close above $0.274 will signal the start of an uptrend.

If Stellar sets up a lower low at $0.228, a bearish scenario might come into play.

XLM price has been on a downtrend since May 23. Any attempts to move above the midpoint of the range have been unsuccessful. Moreover, the recent crash between June 20 and 23 pushed it below the lower end of its trading range, painting a bearish picture.

After a minor upswing, Stellar is now taking a jab at an uptrend if it can reclaim a crucial resistance level.XLM price struggles to climb

XLM price has been on a continuous downtrend since June 3. In fact, Stellar has not produced any higher highs since May 16, which paints a rough idea of how investors view Stellar from an investment standpoint.

Regardless of the lack of optimism around XLM price, a decisive 4-hour candlestick close above the range low at $0.274 will signal a resurgence of bullish momentum. In such a case, Stellar bulls might push the remittance token toward the immediate resistance level at $0.286.

Following a breach of his supply level, if the buying pressure persists, XLM price might tag $0.303, a swing high set up on June 21.

Such a development would allow XLM price to take a jab at breaking the downtrend and kick-start an uptrend. If the buyers manage to set up a swing high above $0.303, it will attract some sidelined investors to jump on the bandwagon, invoking large bid orders. Such a turn of events might hold the key to push the remittance token to $0.352, roughly 28% from the range low.