2021-03-30 10:33

Market analysisBitcoin (BTC), Ethereum (ETH) Forecast:

Related product:

Forex

Market analysis:

Bitcoin (BTC), Ethereum (ETH) Forecast: Visa Adoption to Buoy Cryptos.

Visa’s introduction of a stable coin back by USD to settle transactions may buoy cryptocurrencies prices in the near term.

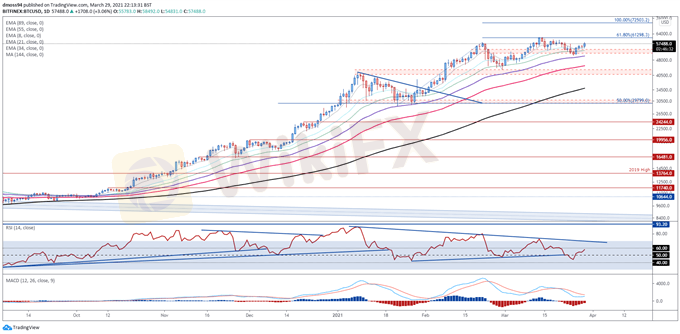

Bitcoin eyeing a push to challenge the yearly high after breaching key resistance.

Ethereum gearing up to extend recent gains as prices coil up in a Symmetrical Triangle pattern.

As mentioned in previous reports, the gradual adoption of Bitcoin, and cryptocurrencies in general, by several well-known financial institutions and companies has painted a rather bullish longer-term outlook for the digital asset space. Tesla invested $1.5 billion in Bitcoin and has begun accepting the popular cryptocurrency as a form of payment, while Bank of New York Mellon stated that it would treat the anti-fiat asset the same as any other financial asset. Mastercard also committed to integrate BTC into its payment networks.

Visa is the latest multinational to embrace blockchain technology, with the company announcing its payments network will utilize a stable coin backed by US Dollars to settle transactions over Ethereum. This move may fuel the fire needed for both Bitcoin and Ethereum to climb to fresh record highs in the coming weeks. Here are the key technical levels to watch for both cryptocurrencies.

Rey

Trader

Hot content

Industry

Event-A comment a day,Keep rewards worthy up to$27

Industry

Nigeria Event Giveaway-Win₦5000 Mobilephone Credit

Industry

Nigeria Event Giveaway-Win ₦2500 MobilePhoneCredit

Industry

South Africa Event-Come&Win 240ZAR Phone Credit

Industry

Nigeria Event-Discuss Forex&Win2500NGN PhoneCredit

Industry

[Nigeria Event]Discuss&win 2500 Naira Phone Credit

Forum category

Platform

Exhibition

Agent

Recruitment

EA

Industry

Market

Index

Bitcoin (BTC), Ethereum (ETH) Forecast:

Philippines | 2021-03-30 10:33

Philippines | 2021-03-30 10:33Bitcoin (BTC), Ethereum (ETH) Forecast: Visa Adoption to Buoy Cryptos.

Visa’s introduction of a stable coin back by USD to settle transactions may buoy cryptocurrencies prices in the near term.

Bitcoin eyeing a push to challenge the yearly high after breaching key resistance.

Ethereum gearing up to extend recent gains as prices coil up in a Symmetrical Triangle pattern.

As mentioned in previous reports, the gradual adoption of Bitcoin, and cryptocurrencies in general, by several well-known financial institutions and companies has painted a rather bullish longer-term outlook for the digital asset space. Tesla invested $1.5 billion in Bitcoin and has begun accepting the popular cryptocurrency as a form of payment, while Bank of New York Mellon stated that it would treat the anti-fiat asset the same as any other financial asset. Mastercard also committed to integrate BTC into its payment networks.

Visa is the latest multinational to embrace blockchain technology, with the company announcing its payments network will utilize a stable coin backed by US Dollars to settle transactions over Ethereum. This move may fuel the fire needed for both Bitcoin and Ethereum to climb to fresh record highs in the coming weeks. Here are the key technical levels to watch for both cryptocurrencies.

Forex

Like 1

I want to comment, too

Submit

0Comments

There is no comment yet. Make the first one.

Submit

There is no comment yet. Make the first one.